Budgeting to Meet Your Goals

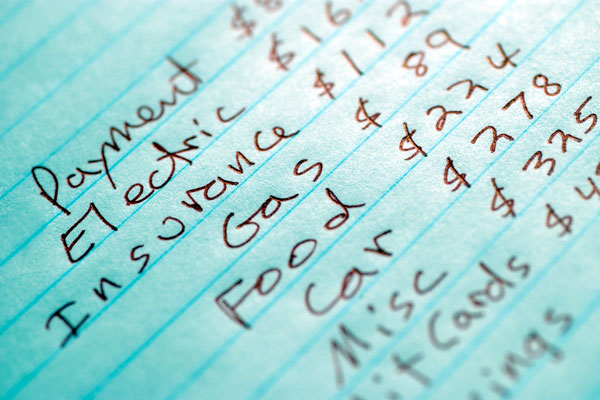

To many people, the term “budget” is often thought of in the same context as four-letter swear words and taboo topics you don’t bring up at family get-togethers. However, while you can choose to change a lot of things about your life, such as how you speak or the topics you bring up with family, the need to budget properly is something that you’ll never be able to avoid. If you fail to budget properly, your financial standing could be debilitating as you go through life. On the other hand, having a firm grasp of your budget and financial standing will allow for you to enjoy more of the life that you live.

The reason that budgeting isn’t talked about very often is because it’s something that many people aren’t quite sure what they are doing. After all, it’s hard to expect someone to understand a budget if they’ve never been exposed to one before.

If you want to take hold of your financial future, then you’ll need to develop a budget for yourself, and potentially your family as well. To better help you, here are some tips for budgeting to meet your goals.

Establish The Goals

In order to know what it is that you need to do to achieve your goals, you’ll first need to establish those goals and the things that you want to accomplish financially. For some people, a financial goal may be to save an extra thousand dollars each year by eating in instead of going out. For others, a financial goal may be to save money to go on a great vacation. Whatever it may be, a goal will give you something to strive for and push towards. If you fail to have goals, then you may instead find yourself just wondering on the path without any real idea of what it is that you are trying to accomplish.

Rely On Technology

Rely On Technology

There are so many technological tools that can help you with your budget, that really anyone can keep up with their financial standing. After you’ve established the financial goals that you have, you can use mobile apps and other programs to help you track your progress. Many of these apps allow for you to put in the goals that you have, as well as your income, expenses, and the financial information. These technological advancements make it much easier for you to track your financial standing and the budget goals that you have for yourself.

If You Fall Off, Get Right Back On

Finally, keep in mind that it’s okay to fall off, as long as you are ready to get back up and keep working towards your budget goals. Many people will end up spending more money than they wanted to, which leads them to knowing they won’t be able to hit their goals. When this happens, it’s common for people to give up all-together and hope to improve the following month. However, those who really want to make the most of their budget will avoid those major fall backs, and instead take the small financial hiccups and make the most of them.

Budgeting is rarely easy, and it’s something that will take time to set up for yourself. However, once you do set it up, you’ll realize that your life is much more organized financially. In addition, your budget will help you get ahead financially, making it certainly worth the time investment you put into it.